In the world of investing, there’s often a divide between those who chase compelling narratives and those who follow the cold, hard facts of profitability and growth. For seasoned investors, the latter approach often proves more rewarding, particularly when dealing with companies like iA Financial. With a market presence under the ticker TSE:IAG, iA Financial not only generates revenue but also profits, presenting a more stable investment opportunity. Understanding the significance of Earnings Per Share (EPS) growth is crucial for investors looking to make informed decisions.

How iA Financial Is Capturing Growth

iA Financial has demonstrated an impressive ability to grow its EPS by 18% annually over the past three years. This consistent growth attracts investors who prioritize financial performance over speculative ventures. Such growth, if maintained, implies a positive trajectory for the company’s share price, providing ample reasons for stakeholders to remain optimistic.

The Importance of Revenue and EBIT Margins

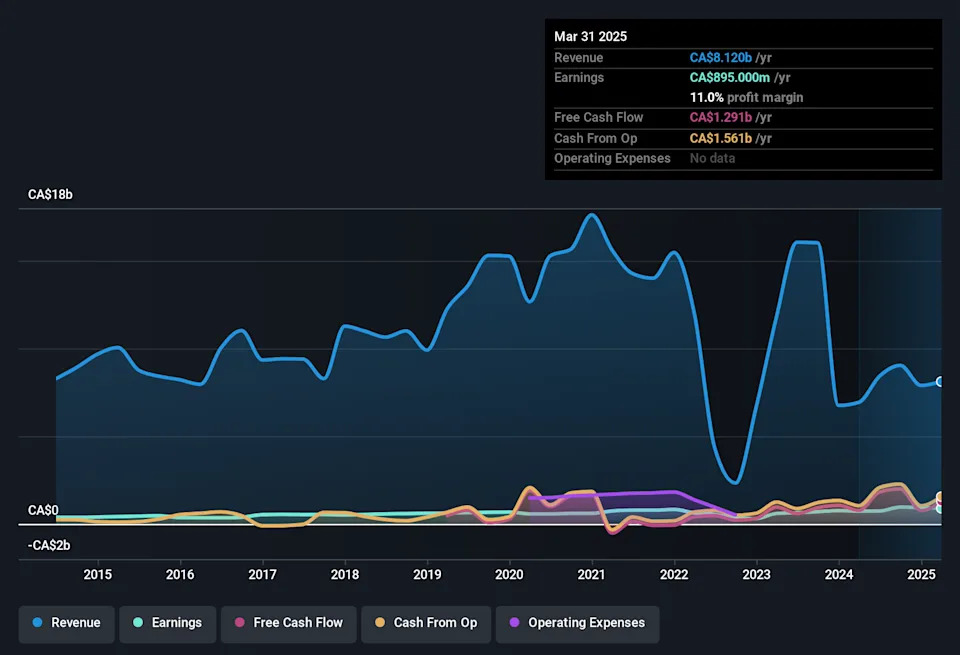

While EPS growth is a promising indicator, it’s essential to consider other financial metrics like revenue growth and earnings before interest and taxation (EBIT) margins. iA Financial’s revenue increased by 17% to CA$8.1 billion, a significant advancement despite its operating revenue being lower than the previous year’s total. The company’s EBIT margins remain consistent, reinforcing the sustainability of its profit growth. Investors should take note of these metrics when evaluating the company’s financial health.

Aligning Insiders and Shareholders

An interesting aspect of iA Financial is the alignment between its insiders and ordinary shareholders. Although insiders hold only about 0.2% of the company’s shares, their investment amounts to CA$22 million. This substantial stake provides a strong incentive for company leaders to act in the best interest of all shareholders, fostering trust and confidence in the company’s governance.

Forecasting Future Performance

While past performance is a reliable indicator, investors are naturally interested in future prospects. To this end, analysts’ forecasts and visualizations of iA Financial’s projected EPS are invaluable. Investors are encouraged to leverage these insights when considering the company’s potential for continued growth.

The Reward of Strategic Investment

For investors, the challenge lies in identifying companies poised for future success, rather than those basking in past glory. iA Financial’s robust EPS growth, consistent revenue increase, and management alignment make it an attractive option for those looking to invest in companies with sound fundamentals. While it’s impossible to predict the future with certainty, informed investors can make strategic decisions by analyzing financial data and market trends.

For those interested in staying updated with the latest in fintech news, visit fintechfilter.com.

Note: This article is inspired by content from https://finance.yahoo.com/news/eps-growth-important-ia-financial-193546148.html. It has been rephrased for originality. Images are credited to the original source.