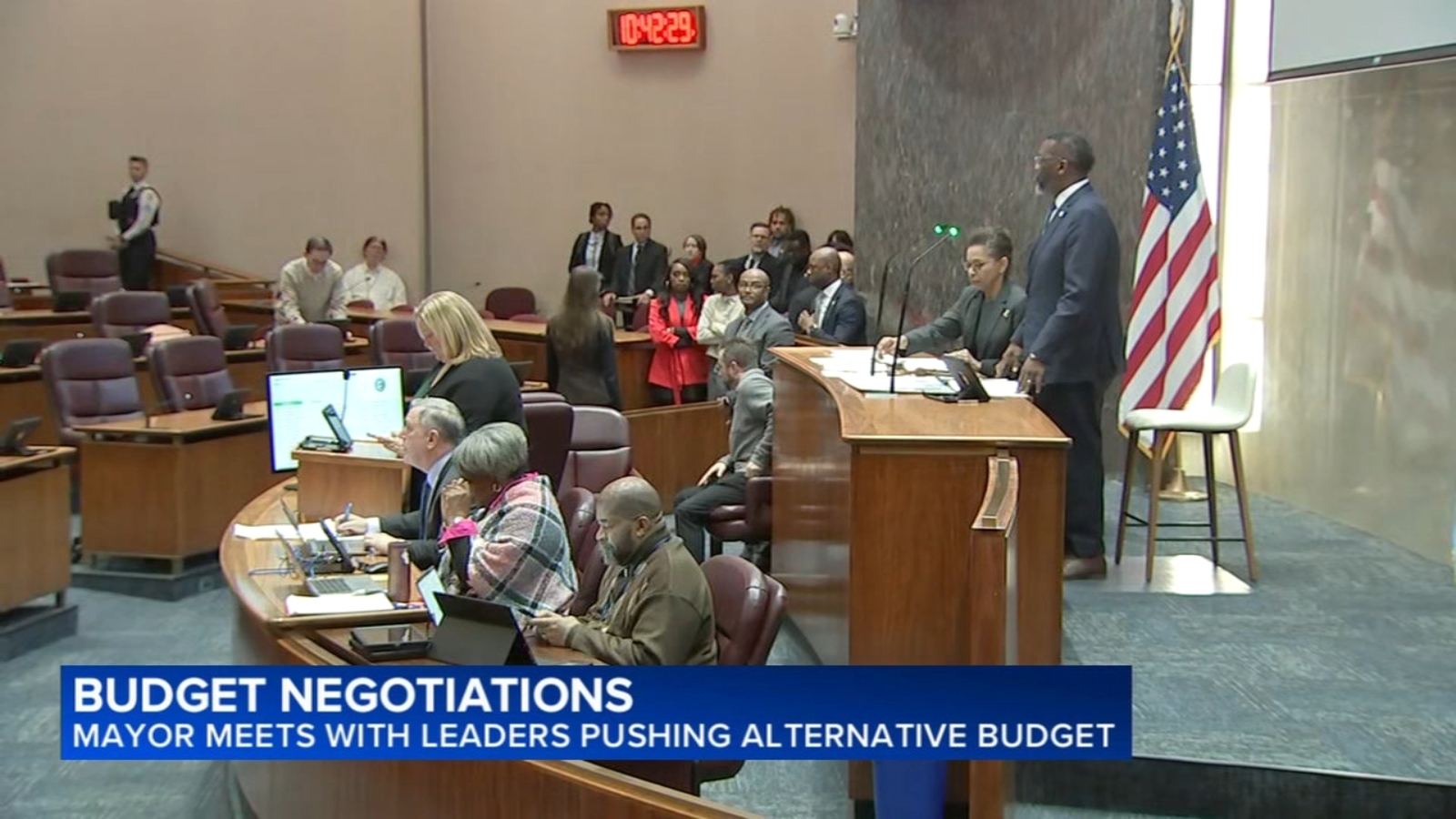

Chicago Finance Committee Moves Forward with Revised 2026 Budget

The Chicago City Council’s Finance Committee has approved an alternative 2026 budget framework that notably excludes the controversial head tax proposed by Mayor Brandon Johnson. The decision marks a significant shift in the city’s fiscal planning and signals ongoing debate over how to balance economic growth with city revenue needs.

Controversial Head Tax Dropped Amid Concerns

The proposed head tax—an employer-paid fee for each worker employed in the city—had drawn criticism from business leaders and some city council members. Opponents argued that it would discourage job creation and could lead to businesses relocating outside city limits. Mayor Johnson had initially included the head tax as part of his broader plan to generate new revenue for public programs and infrastructure improvements.

However, in response to mounting opposition, the Finance Committee opted to move forward with a modified budget proposal that removes the head tax while still aiming to meet the city’s financial obligations for 2026. The revised plan garnered enough support to pass the committee stage, setting the stage for a full City Council vote.

Mayor Johnson’s Vision and Pushback

Mayor Brandon Johnson has championed a progressive tax strategy aimed at providing more funding for underserved communities, education, and affordable housing. The head tax, a remnant from previous city budgets before being repealed in 2011, was reintroduced as part of this vision. Johnson’s administration argued that the tax was a fair way to ask large employers to contribute more to the city’s welfare.

“We must invest in our people and our neighborhoods,” Johnson said in a recent statement. “Revenue solutions like this are essential if we’re going to build a Chicago that works for everyone.”

Yet, many aldermen and business stakeholders expressed concern that reintroducing the head tax would send the wrong message to companies already dealing with high inflation and post-pandemic economic challenges. The Illinois Chamber of Commerce and local business coalitions lobbied heavily against the measure.

Alternative Revenue Options Under Consideration

With the head tax off the table, the Finance Committee’s revised proposal includes a mix of cost-saving measures and alternative revenue streams. These include increased enforcement of existing tax codes, modest adjustments to property taxes, and public-private partnerships to fund infrastructure projects.

Committee Chair Ald. Pat Dowell emphasized the importance of collaboration in the budget process. “This is about finding a workable solution that supports our communities while keeping Chicago competitive for business investment,” she said during the committee hearing.

Public Reaction and Next Steps

The removal of the head tax has been met with mixed reactions from Chicago residents and advocacy groups. Some community organizers argue that without bold new revenue measures, the city may fall short in addressing long-standing issues like homelessness, school funding gaps, and public safety concerns.

On the other hand, many in the business community welcomed the decision. “This sends a positive signal to employers that Chicago is open for business and focused on sustainable growth,” said Jack Lavin, president of the Chicagoland Chamber of Commerce.

The Finance Committee’s vote is just one step in the complex budget approval process. The full City Council is expected to review and vote on the revised budget plan in the coming weeks. Lawmakers will also hold public hearings to gather input from residents and stakeholders.

Looking Ahead to Chicago’s Fiscal Future

As the city prepares for the 2026 fiscal year, balancing progressive ideals with economic realities remains a challenge. Mayor Johnson has signaled that while the head tax may be off the table for now, other progressive revenue strategies could be revisited in future budget discussions.

“This is a long-term effort,” Johnson said. “We’ll continue to fight for a budget that reflects our values and meets the needs of every Chicagoan.”

The revised budget proposal reflects a pragmatic approach to city governance, one that acknowledges political realities while striving for equity and fiscal responsibility. Whether the full council will approve the modified plan remains to be seen, but the current direction suggests a focus on compromise and forward planning.

This article is inspired by content from Original Source. It has been rephrased for originality. Images are credited to the original source.