In today’s fast-paced digital world, the way we handle money and make payments is rapidly evolving. Enter Capitec Pay, a new payment solution from Capitec Bank that’s making waves in South Africa.

But what exactly is Capitec Pay, and why should you care? Let’s break it down.

What is Capitec Pay?

Capitec Pay is a digital payment method introduced by Capitec Bank, one of South Africa’s largest retail banks. It allows customers to make online payments directly from their Capitec bank accounts without needing to use a card or share sensitive banking details.

Essentially, Capitec Pay leverages a direct-to-bank API (Application Programming Interface) that connects the customer’s bank account directly to the merchant, enabling secure and seamless transactions.

How Does Capitec Pay Work?

Using Capitec Pay is straightforward and designed with the user’s convenience in mind. Here’s a step-by-step overview of how it works:

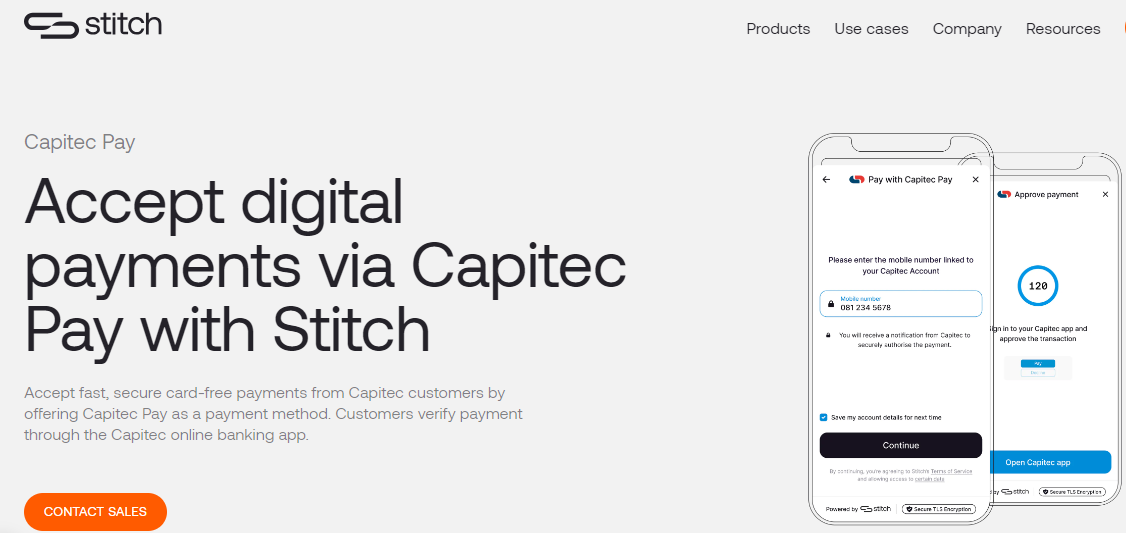

- Select Capitec Pay at Checkout: When shopping online, choose Capitec Pay as your preferred payment method on the merchant’s website or app.

- Verify Your Identity: Enter your mobile number, account number, or ID number to verify your identity securely.

- Approve the Payment: Once verified, you’ll receive a prompt on your Capitec banking app to approve the payment.

- Complete the Transaction: Upon approval, the payment is processed directly from your bank account to the merchant’s account as an Automated Clearing House (ACH) or Electronic Funds Transfer (EFT) transaction.

Why Should You Care About Capitec Pay?

Enhanced Security

Unlike traditional payment methods that require sharing sensitive information such as card numbers or CVVs, Capitec Pay eliminates the need to disclose these details. Instead, transactions are authorized directly through your secure Capitec banking app, significantly reducing the risk of fraud and identity theft.

Convenience and Speed

Capitec Pay simplifies the payment process by connecting your bank account directly to the merchant, bypassing the traditional card networks. There’s no need to dig out your wallet or remember card details—everything is handled swiftly and securely through your mobile device.

Lower Transaction Costs

Credit card transactions often come with hefty fees due to the involvement of multiple intermediaries. In contrast, Capitec Pay’s direct-to-bank approach reduces these fees, potentially leading to lower prices for consumers and higher profit margins for merchants.

Greater Inclusivity

By providing a payment method that works directly from a bank account, Capitec Pay opens up digital commerce to a broader audience, fostering greater inclusivity and financial accessibility.

Supporting the Future of E-commerce

As e-commerce continues to grow, the need for secure, fast, and reliable payment solutions becomes more crucial. Capitec Pay is at the forefront of this evolution, offering a forward-thinking payment method that aligns with the needs of modern consumers and businesses.

Conclusion

Capitec Pay represents a significant step forward in the world of digital payments. With its emphasis on security, convenience, and inclusivity, it’s a payment method designed for the modern era. It’s not just about making payments easier—it’s about shaping the future of how we handle money. So, next time you’re checking out online, consider giving Capitec Pay a try—you might just find it’s exactly what you’ve been looking for.