Small and Medium Enterprises (SMEs) as the name suggests are small businesses running all around the world. There are specific numbers of workers and the amount of revenue they bring in so as to be called SMEs. These numbers differ from country to country and so is the definition.

The definitions may differ from country to country but one thing agreed by all is that, although small they contribute a lot to a country’s economy. It creates the majority of job opportunities while also playing a key role in the development of its economy. According to the World Bank Group SMEs are about 90% of a country’s business and make up 50% of employment. With 40% of national income generated by formal SMEs alone in developing countries, SMEs are a high priority in order to meet the growing demand for jobs.

Small and Medium Enterprises Finance Gap

Although its importance is vital, one important problem faced by SMEs is the shortage of funding. When compared, it is much easier for larger businesses to get loans or investments. This financial shortage as compared to other businesses is known as the SME finance gap.

It has been noted that instead of taking loans from banks SMEs usually manage their business either with their own cash or by borrowing with friends and relatives. According to the International Finance Corporation(IFC), 40% of small and medium formal enterprises in developing countries have about 5.2 trillion in shortage of funds annually.

Additionally, as given by SME Forum women-owned businesses measure up to 23% of SMEs while contributing up to 32% of the finance gap.

But this financial gap also differs from region to region. East Asia and the Pacific have the highest financial gap 45% approx. This is followed by Latin America and the Caribbean at 21% then followed by Europe and Central Asia at 15%. Then there is sub-Saharan Africa and South Asia at 6% and at last Middle East and North Africa at 3%. This is according to SME Forum and is calculated with US dollars.

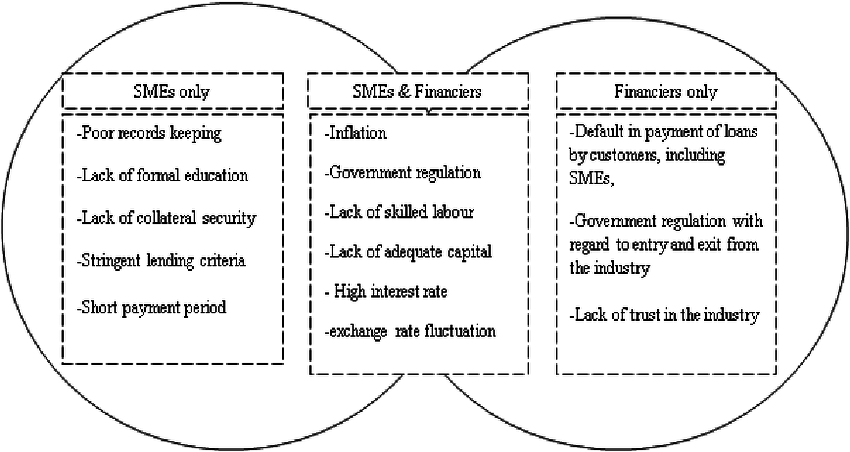

Challenges Faced by Small and Medium Enterprises

Shortage of Funding

The main challenge faced by SMEs is the shortage of funding. This occurs due to banks unwilling to give loans to small businesses because of the risks it entails. But this to small businesses means they have no availability of money to invest or to develop or even to start their business. As a result, small businesses remain stagnant and do not grow anymore.

To add to the problem, when the business owner could not get anything from the banks most of them turned to loans from private lenders, friends and relatives, or even from their own savings. This is a high risk but many could not get money even in such a manner.

Additionally, no funding or enough cash leads to multiple challenges

Marketing

With not enough money to spare, marketing becomes a burden. Marketing and advertising a product or business is one of the key features to make sure it is well-known and successful. But to most SMEs, marketing seems more of a luxury when it should be a necessity.

Competition

One fact remains that small industries do not compete only with small industries. Their rival would be conglomerates and the biggest in the industries. These big firms have endless funding and investments and have dozens of experts in different fields working for them. But the fields in which small sector and big sectors work are the same. Thus, one of their main challenges is facing such rivals with their limited resources.

Another thing with competition is that the world itself is in competition. It is changing and developing rapidly, thus when a small business develops itself taking a lot of time due to a shortage of resources, the system has already changed most of the time. For example with the recent burst in internet usage, online transactions have become a norm. But to businessmen who have just perfected the traditional way of opening stores, this becomes a great challenge as they have to be the ones to learn the change and adapt. Hiring someone as large firms would do, is a financial burden to small and medium enterprises.

What are the biggest challenges for Small Business?

Probable Solution

The solution has to begin from the grassroots level. The first thing to always do is be a learned person in your field. Make sure you are able to know exactly what you are doing. If you are interested in any kind of business, make sure you study it properly then draw up a dependable plan, budget properly, have a marketing plan, and take help when needed.

Then when you have a plan, construct a proper business proposal plan that can be submitted to the bank which would increase the likelihood of banks giving you loans.

Another way is to research thoroughly. Due to the importance of SMEs in the country’s economy, there are several government grants, investment companies, or specific organizations that work to decrease the SME financial gap. Researching and identifying such entities and partnering with them will be useful to the businesses.

One such entity is The World Bank Group which is working on several projects in different parts of the world like Lebanon, Jordan, India, etc. with different like of assessment, innovation work, and making policies to shorten the gap. They also provide certain lending operations to alleviate small businesses.

Many such organizations have emerged in recent times, and identifying them and getting their help is the duty of the businessman.

Another solution is given by a blog from the World Bank, digital financial services is another solution for closing the financial gap. As with digital platforms, many funding services are made available to businesses that were not available before. It also brought them funding as well as information much easier and more comfortable. Every country should try to make sure such information is available to their businesses to make the best out of it.

Conclusion

SMEs’ financial gap is thus a problem that we are facing currently and solving it even to a small degree will bring much prosperity to our economy. It is one sector that highly dominates our job structure and can also provide much more employment down the road. The beneficiaries of Small and Medium Enterprises are key to making a booming economy in any country.

Leave a Reply