Asset Management refers to the process of handling and managing the investment on behalf of clients and shareholders. The assets can range anywhere from shares, stocks, bonds to real estate and various other commodities. Various asset management also known as investment firms exist with the specialization in managing assets for individuals, privately held institutions, and sometimes government as well.

Image Credits: Pexels

The primary goal of an asset management institution is to maximize profits while eliminating the risks associated with the same. Asset management can be done through various strategies, including active management, where portfolio managers actively buy and sell assets in an attempt to outperform the market or passive management, where managers aim to match the performance of a particular market index.

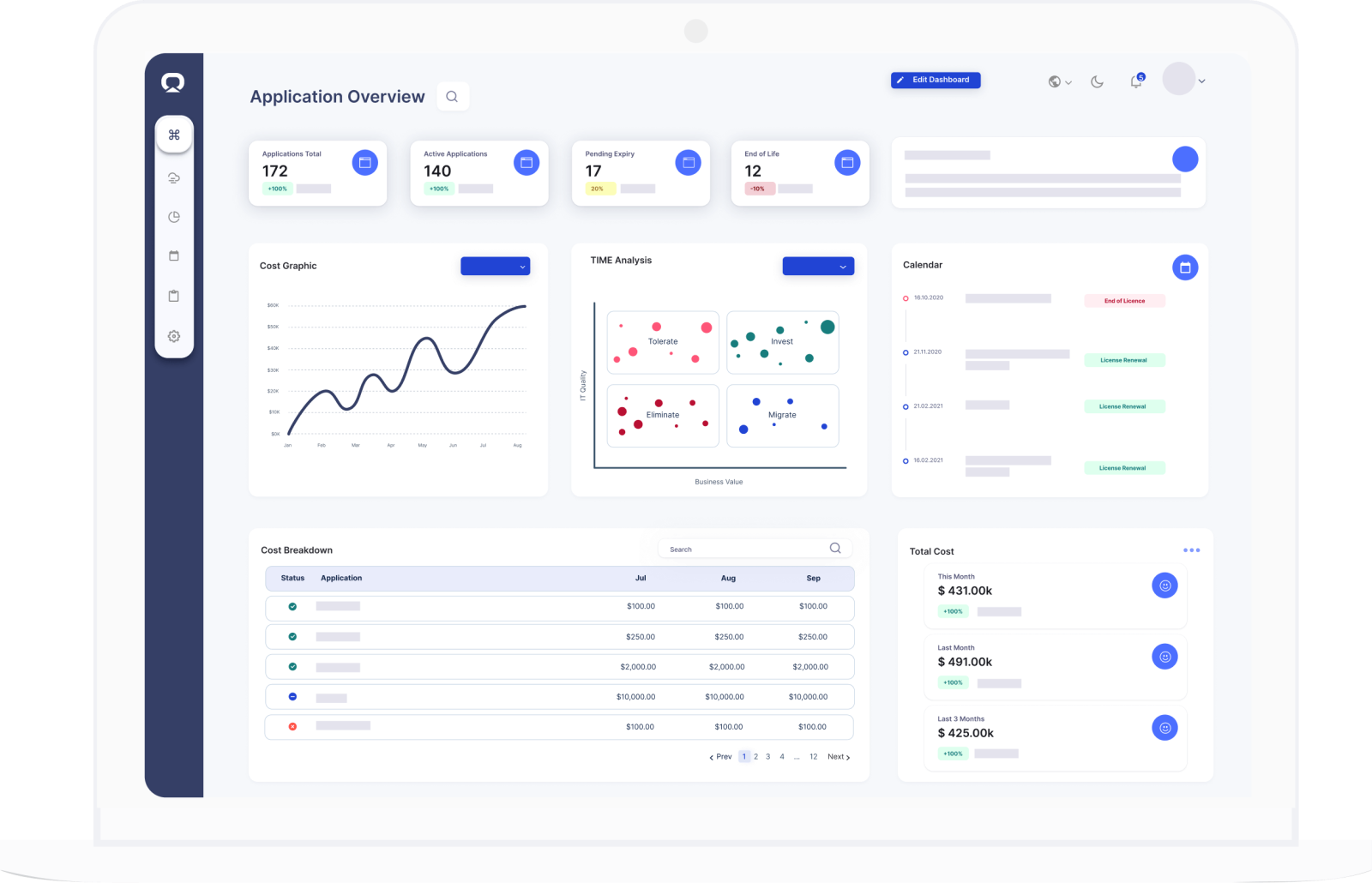

Various tools and software are designed to accordingly suit the working mechanism of asset management. In today’s blog, we are going to understand the functionality of a few software that are highly valued in the asset management industry.

VISE

Image Credits: https://images.app.goo.gl/cSH4DS6vkTj9JqnK9

Vise is an investment management company, privately held in New York City. Founded in the year 2016 it is a technology-powered asset manager that helps financial advisors build, manage, and explain personalized portfolios. Vise’s mission is to enable financial advisors to deliver better investment outcomes to their clients while scaling to their maximum potential.

The company is leading the industry-wide shift toward Wealth 3.0—the next step beyond mutual funds, ETFs, and index funds into personalized, automated portfolios. Backed by investors like Sequoia, and Founders Fund, Vise has raised nearly $130 million since its founding in 2016. The company has over 45 employees based across the U.S. with headquarters in New York. Its specialties include Investment Management, RIA, Financial Advisors, Fintech, Financial Services, Portfolio Management, Investment Methodology, Personalized Investing, Customized Investing, Direct Indexing, Factor Investing, ESG Investing, and Artificial Intelligence.

Vise is merging investing and technology in a seamless experience for financial advisors

EquityBee

Image Credits: https://images.app.goo.gl/8gKUjDoZ1zUc4hux8

EquityBee is an online platform for helping startup employees exercise their stock options and receive pre-IPO shares from privately held companies. It provides education about acquiring earned stock options and funding for acquiring the shares to startup employees. It was co-founded in 2017 by Oren Barzilai, Oded Golan, and Mody Radashkovich, and is based in Palo Alto, California, United States.

The EquityBee platform helps startup employees exercise their stock options before they expire. The platform is built and managed by an affiliate of EquityBee Inc. By law, employees have a limited period of time to exercise their stock options when they leave a startup. Lack of finances to cover the cost of employee stock ownership plans (ESOPs) and resulting taxes often lead to the expiration of an employee’s vested stock options. Equitybee matches startup employees with its network of selected investors. The investors provide capital that covers the cost of purchasing startup stock options, as well as the accompanying taxes, for a share in potential future gains.

How Equitybee helps Employees finance their stock options

DriveWealth

Image Credits: https://images.app.goo.gl/jJAcZuthi3sjwx1q9

DriveWealth is a financial service company, privately held in New York City. It is a global B2B financial technology platform. Their core business is providing Brokerage-as-a-Service, powering the investing and trading experiences for banks, broker-dealers, asset managers, digital wallets, and consumer brands. DriveWealth’s APIs provide their Partners with a modern, extensible, and flexible toolkit to develop everything from traditional investment workflows to more innovative techniques such as rounding up purchases into fractional share ownership.

AlphaSense

Image Credits: https://images.app.goo.gl/N8esSjrDVt1TL3Z46

AlphaSense is the world’s most sophisticated company that removes uncertainty from its decision-making. With market intelligence and search built on proven AI, AlphaSense quickly delivers relevant insights from a trustworthy universe of public and private content—including equity research, company filings, event transcripts, expert calls, news, trade journals, and clients’ own research content. Headquartered in New York City, AlphaSense employs over 1,000 people across offices in the U.S., U.K., Finland, India, and Singapore.

How to Use AlphaSense

Addepar

Image Credits: https://images.app.goo.gl/UMci2tsen3932d9U7

Addepar is a global technology and data company that helps investment professionals provide the most informed, precise guidance for their clients. Hundreds of thousands of users trust Addepar to empower smarter investment decisions and better advice. With a client presence in more than 40 countries, Addepar’s platform aggregates portfolio, market, and client data for over $5 trillion in assets. Addepar’s open platform integrates with more than 100 software, data, and services partners to deliver a complete solution for a wide range of firms, use cases, and geographies. Addepar embraces a global flexible workforce model with offices in Silicon Valley, New York City, Salt Lake City, Chicago, London, Dublin, Edinburgh, Scotland, and Pune, India.

Addepar’s Mike Paulus discusses wealth management technology for financial advisors

Conclusion

In conclusion, asset management software offers significant advantages in today’s complex business environment, helping organizations effectively manage their assets throughout their lifecycle. However, it’s crucial for businesses to carefully evaluate their specific needs, choose the right software solution, and ensure proper implementation and ongoing maintenance to fully leverage its benefits.

Leave a Reply