Embedded finance has swiftly transitioned from a mere buzzword to a pivotal element of the global financial framework. Its emergence heralds transformative implications that transcend conventional banking boundaries. Recent studies indicate that the embedded finance market, valued at $43 billion in 2021, is poised to skyrocket to $138 billion by 2026. Like the term ‘fintech’, embedded finance encompasses varied interpretations and applications across industries and enterprises. Let’s delve deeper into embedded finance and its profound impact, especially on banks.

Source; A deep dive on Embedded Finance – Embedded Finance Stories by FinBox

Fundamentally, embedded finance entails integrating financial services into non-financial platforms and procedures. This fusion facilitates seamless financial transactions and services within established digital ecosystems, spanning e-commerce platforms, ride-sharing applications, and social media networks. By embedding financial functionalities directly into these platforms, users can access a spectrum of banking services without leaving their digital environment.

Source; What is Embedded Finance and how it will change FinTech.

For banks, embracing embedded finance presents a multitude of opportunities and advantages. Firstly, it enables banks to broaden their outreach and customer base by leveraging the expansive user networks of non-financial platforms. By embedding financial services into popular digital platforms, banks can effectively reach new demographics and cater to the evolving demands of tech-savvy consumers.

Furthermore, embedded finance empowers banks to provide personalized and context-aware financial solutions tailored to individual user preferences and behaviors. Leveraging data amassed within digital ecosystems, banks can delve deeper into customer needs and preferences, delivering targeted products and services that resonate on a personal level.

Source; FinBox

Moreover, embedded finance fosters heightened customer engagement and loyalty by seamlessly integrating banking services into users’ daily experiences. Whether making payments within a mobile app, accessing credit options while shopping online, or managing finances within a social media platform, embedded finance enhances convenience and accessibility, fortifying the bond between banks and customers.

Source; Intro to Embedded Finance

Additionally, embedded finance unlocks novel revenue streams and business models for banks, allowing them to monetize their financial infrastructure and expertise innovatively. Offering white-label financial products and services to non-financial partners enables banks to generate additional revenue while expanding their brand presence and market reach.

Source; Embedded finance benefits | IDEMIA

However, alongside these opportunities, banks must navigate challenges and considerations when embracing embedded finance. Privacy and data security concerns loom large, given the integration of financial services into non-financial platforms. Ensuring robust security measures and regulatory compliance is paramount to safeguarding customer data and upholding trust in the digital ecosystem.

Source; https://www.trevipay.com/resource-center/blog/what-is-embedded-finance-why-it-matters/

Source; What is embedded finance? 4 ways it will change fintech | Plaid

Types of Embedded Finance

Source; Embedded Finance

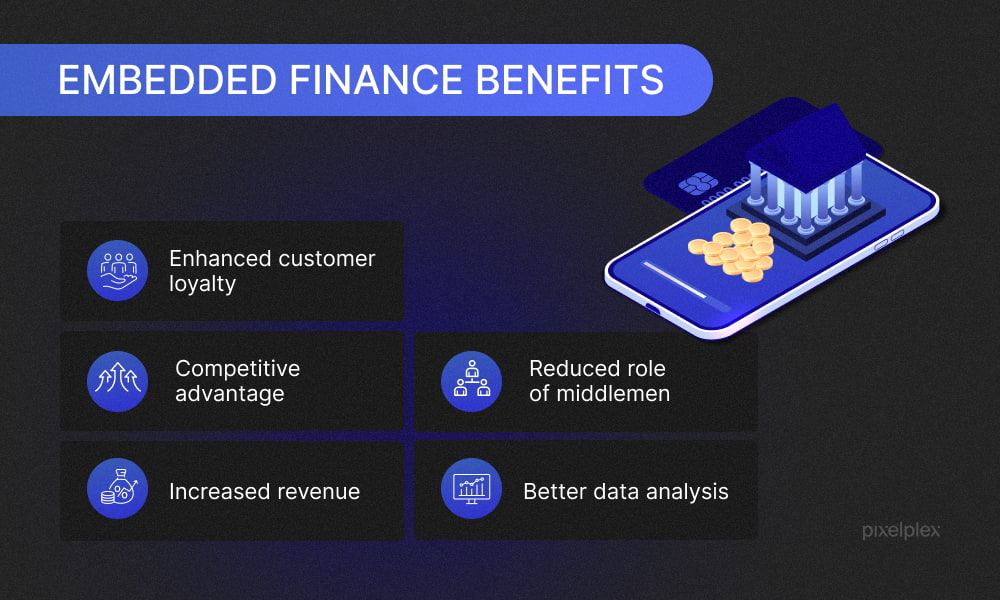

Advantages of Embedded Finance

Benefits of Embedded Finance for Businesses

1. Enhanced Competitiveness and Customer Confidence: Websites offering financial products like insurance, easy financing (EMIs), and online payment options tend to attract more customers compared to those lacking such options, fostering a competitive edge and building trust among consumers.

2. Increased Average Order Value and Additional Revenue Streams: Businesses earn a portion of revenue from financial products sold on their platforms, thereby boosting overall earnings and diversifying income sources.

Source; What is Embedded Finance: Key Benefits and Types

Benefits of Embedded Finance for Financial Institutions

1. Streamlined Customer Acquisition: Financial institutions benefit from easier access to customers through partnerships with businesses offering embedded finance solutions, expanding their client base and market reach.

2. Targeted Data Collection: Embedded finance facilitates the gathering of relevant customer data, enabling financial institutions to tailor their offerings and services to meet specific consumer needs and preferences.

3. Simplified Customer Management: Responsibility for managing consumer interactions and lifecycle management is shared between financial institutions and businesses, reducing the burden on financial entities and enhancing customer service efficiency.

Source; Embedded Finance: why banks are at a crossroads

Benefits of Embedded Finance for Users

1. Enhanced Convenience: Users enjoy seamless access to financial services such as online payment options and EMI facilities while browsing websites or using apps, improving overall user experience and convenience.

2. Relevant Offerings: Embedded finance ensures that financial products and services available to users are not only conveniently accessible but also aligned with the context of the website or app they are using.

Source; On Embedded Finance and the Real Economy

3. Personalized Offerings: Unlike traditional financial services, embedded finance fintech offers tailored solutions to consumers, catering to their specific needs and preferences with customized options such as ‘buy-now-pay-later’ or personalized loan offers at checkout.

4. Financial Inclusion: Embedded finance extends formalized financial services to underserved users who may face barriers to accessing traditional banking services, promoting financial inclusion and accessibility.

5. Improved User Experience: Access to added financial benefits enhances the overall shopping or browsing experience for consumers, contributing to higher satisfaction levels and increased loyalty to the platform.

Source; 11 Benefits of Embedded Finance and How it Transforms the Fintech| Cigniti

How Embedded Finance Functions

The emergence of embedded finance is propelled by four fundamental shifts:

1. Transition to E-commerce: The digitalization of commerce has facilitated the integration of financial services into digital platforms, creating a seamless customer experience. E-commerce merchants incorporate financial offerings like ‘Buy Now, Pay Later’ (BNPL) financing, branded credit cards, and rewards programs into their checkout processes to enhance sales. On-demand platforms such as ride-hailing apps and freelance marketplaces also offer digital wallets, payment solutions, and wealth management tools to attract both producers and consumers.

Source; Embedded Finance: Everything You Need to Know

2. Advancements in Technological Integration: The rapid evolution of fintech and Application Programming Interfaces (APIs) has made it easier and more scalable to integrate financial services into non-financial platforms. Digital onboarding, electronic Know Your Customer (KYC) processes, and real-time data connections facilitate prompt and hassle-free transactions for customers. APIs empower Software as a Service (SaaS) and subscription-based services to incorporate flexible payment options, in-app invoicing, and lines of credit for business users.

3. Shift in Consumer Expectations: Consumers increasingly embrace nontraditional providers for financial services, driven by a desire for convenience and streamlined experiences. The widespread adoption of smartphones, fintech applications, e-commerce platforms, and digital banking has catalyzed this shift in consumer attitudes.

Source; BaaS and Embedded Finance – “What are the benefits?”

4. Addressing the Underserved: The challenge of serving individuals not catered to by traditional banks and financial institutions has prompted innovative approaches. Some advocate for embedding finance into everyday transactions as a means to democratize finance and broaden access to financial products. Others propose behavioral economic strategies, such as embedding insurance options directly into transactions like ride-sharing, to simplify decision-making for those who may lack the time or knowledge to seek out such services independently.

According to Hensen and Kötting, embedded finance signifies a transformation of banking itself. This transformation primarily revolves around customizing banking services to meet the needs of partners or the demands of specific products. Ultimately, fundamental flexibility is essential to support these developments and comply with upcoming regulatory frameworks, such as the EU’s planned Open Finance Framework.

In summary, embedded finance represents a substantial paradigm shift in the banking landscape, offering banks unprecedented avenues for innovation, expansion, and success in the digital era. Seamlessly integrating financial services into non-financial platforms enhances customer experiences, drives growth, and unlocks new revenue streams. Yet, navigating the complexities of embedded finance requires careful consideration of privacy, security, and regulatory implications. As the landscape evolves, banks adept at embracing embedded finance stand to gain a competitive edge in the swiftly evolving financial landscape.