Source: wocop

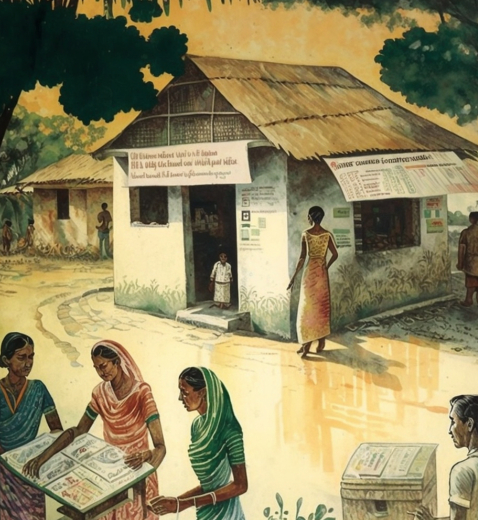

What is a regional rural bank?

Regional Rural Banks (RRBs) are government-owned banks that operate at the regional level across various states in India. They are specifically structured to meet the financial needs of rural communities, playing a pivotal role in fostering financial inclusion at the grassroots level. Presently, India boasts 43 RRBs, each sponsored jointly by the Government of India, respective State Governments, and a sponsoring bank.

Ownership of Regional Rural Banks

Regional Rural Banks are owned by three entities:

- Central Government with a share of 50%

- State Government with a share of 15% and

- Sponsor Bank with a share of 35% (Any commercial bank can sponsor the regional rural banks).¹

Regulations of RRBs in India

In India, the regulation of Regional Rural Banks (RRBs) is overseen by two key institutions: the Reserve Bank of India (RBI) and the National Bank for Agricultural and Rural Development (NABARD).

- RBI: Governed by the RBI Act of 1934 and the Banking Regulation Act of 1949, the Reserve Bank of India is one of the primary regulators of commercial banks in India.

- NABARD: Established on July 12, 1982, NABARD serves as the principal regulatory body for the rural banking sector in India. It aims to facilitate the efficient flow of funds from urban to semi-urban and rural areas of the country. NABARD is primarily responsible for overseeing, planning, and policymaking activities related to the credit system of rural banks. It also plays a pivotal role in the development of rural banks and conducts regular supervision to ensure their proper functioning.

The objectives of Regional Rural Banks (RRBs) are as follows:

The objectives of Regional Rural Banks (RRBs) in India encompass the following functions:

1. Establishing bank branches in rural areas to enhance accessibility to financial services.

2. Extending loans to support the agricultural sector’s development, benefiting small-scale farmers, agricultural laborers, and entrepreneurs.

3. Facilitating employment generation within rural communities.

4. Promoting a culture of savings among rural residents, accepting deposits, and utilizing funds for productive endeavors.

5. Shielding individuals from exploitation by money lenders through fair and transparent financial services.

6. Lowering the cost of lending in rural regions, thereby promoting economic growth and prosperity.

Source: RBI

Functions of Regional Rural Banks (RRBs) in India:

Banking Operations:

- Authorized to conduct banking business as defined in the Banking Regulation Act 1949.

- Grant loans to various segments including small and marginal farmers, agricultural laborers, cooperative societies, artisans, small entrepreneurs, and individuals with limited means.

Core Banking Functions:

- Perform typical banking activities like accepting deposits from the public, providing credit facilities, and offering remittance services.

- Invest in government securities and deposit schemes of banks and financial institutions.

Refinance Facilities:

RRBs can avail of refinance facilities provided by NABARD for the loans they sanction and disburse.

Regulatory Compliance:

- Covered under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme.

- Required to adhere to RBI stipulations regarding Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

Priority Sector Lending:

- Mandated by the Reserve Bank of India to comply with Priority Sector lending norms since April 1997.

- Required to allocate 40% of their Net Bank Credit to Priority Sector, with a specific portion dedicated to weaker sectors.²

Amalgamation of RRBs

In 2001, the Reserve Bank of India formed a Committee chaired by Dr. V S Vyas to assess the role of Regional Rural Banks (RRBs) in rural credit systems and explore operational alternatives. Subsequently, in 2005, based on the committee’s recommendations, a consolidation process was initiated.

The first phase of amalgamation, initiated in 2005, focused on consolidating RRBs sponsored by the same banks within a state. This reduced the number of RRBs from 196 to 82, aiming to improve customer service through enhanced infrastructure, computerization, skilled workforce, and unified marketing efforts.

Further amalgamation efforts in 2011 aimed at providing amalgamated RRBs with broader operational areas and increased credit exposure limits for diverse banking activities. This phase brought down the number of RRBs to 56 from 82.

In 2018-2019, following a roadmap provided by NABARD and after consultations with sponsor banks and state governments, another round of amalgamation was carried out. By April 2019, the number of RRBs had decreased to 43 from 56. The objective behind these amalgamations is to achieve greater efficiency of scale, higher productivity, improved financial health for RRBs, and increased credit flow to rural areas.

The organizational structure of Regional Rural Banks (RRBs) varies based on the size and characteristics of each RRB. Generally, the hierarchy of officials in an RRB is as follows:

1. Board of Directors

2. Chairman & Managing Director

3. General Manager

4. Assistant General Manager

5. Regional Manager/Chief Manager

6. Senior Manager

7. Manager

8. Officer

9. Office Assistant

10. Office Attendant

This hierarchical arrangement ensures effective management and operations within the RRB, catering to the diverse needs of rural and semi-urban areas.

Reference;

[1] “Complete Regional Rural Banks In India History List Of RRBs.” Guidely, 5 March 2024, Accessed 14 March 2024.

[2] https://youtu.be/-chvvQHczXo?si=L7Ic9NFQCb1RjNiV

[3 ]“Regional Rural Banks of India: Important Functions of RRBs in India.”BankersAdda, 6 June 2020, Accessed 14 March 2024.

Leave a Reply