What is quantitative trading?

Quantitative trading employs computer software to analyze mathematical models and calculations, identifying patterns and trends in stock price movements. This strategy aims to select undervalued stocks and execute profitable trades with precise timing.

Source: backtestmarket.com

How does quantitative trading work?

The quantitative trading strategy typically relies on inputs such as price and volume of trades. However, stock price fluctuations often lack a consistent pattern and instead demonstrate cyclical trends. This is where quantitative techniques come into play, enabling traders to capitalize on these trends.

These trading models utilize price and volume as fundamental inputs for constructing mathematical models, with technology serving as a key component for faster and more profitable trade execution. Grounded in algorithmic and sophisticated statistical models, these strategies are characterized by their rapid pace and short-term trading objectives. Quantitative traders leverage numerical tools like moving averages, harnessing technology and mathematical/statistical models to craft precise trading strategies. They begin by formulating a trading strategy and then develop a mathematical model based on historical data, which is subsequently tested and refined.

The outcomes generated from implementing these techniques are applied to actual capital and market trading. The operation of these models resembles that of climate forecasting, employing probabilistic techniques based on historical data to predict future market conditions. Traders employ similar methodologies with market data to inform their investment decisions.

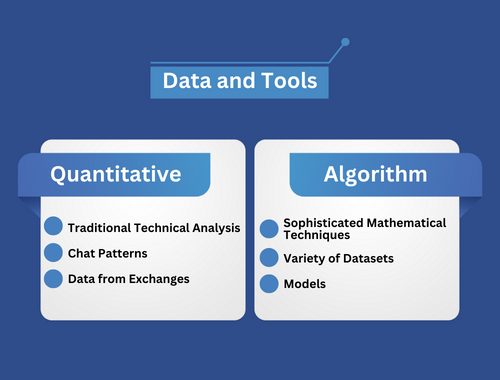

Tools for quantitative or Algorithmic trading

ALPACA

Quantitative trading with Alpaca revolutionizes the way traders approach the financial markets by combining cutting-edge technology with advanced mathematical models. Here’s a breakdown of how Alpaca facilitates quantitative trading:

Quantitative trading with Alpaca integrates advanced technology and mathematical models to revolutionize trading strategies. By leveraging quantitative techniques, traders can analyze market data efficiently and make informed decisions based on price, volume, and other indicators. Alpaca’s platform facilitates the development, testing, and implementation of trading strategies, offering seamless integration with brokerage services for live trading. With a focus on algorithmic trading and short-term goals, Alpaca empowers traders to capitalize on market opportunities while providing a supportive community and resources for success.

Serving algo traders and quant funds

Website: https://alpaca.markets

Linkedin:https://www.linkedin.com/company/alpacamarkets/

Industry: Financial Services

Company size: 201-500 employees, 189 associated members

Founded: 2015

Specialties: Finance, Trading, Fintech, Algorithm Trading, Investing, platform, quant, trading bot, API, Developer, crypto, crypto trading, embedded fintech, stock trading, and investing apps.

Strategy quant

StrategyQuant offers a comprehensive suite of tools and features designed to empower traders in the field of quantitative trading. Users can build, re-test, improve, and optimize quantitative trading strategies using advanced algorithms and mathematical models. The platform provides a walk-forward optimizer and cluster analysis tools to enhance strategy performance and reliability. Automatic overfitting tests and Monte Carlo analysis help users identify robust trading strategies that are less susceptible to market fluctuations. With a multi-timeframe and multi-market back tester, traders can evaluate strategies across different market conditions and timeframes. StrategyQuant also offers a wide range of indicators, price patterns, and other analytical tools, totaling more than 40 options to aid in strategy development. Additionally, users have access to free historical tick data, enabling them to backtest strategies with accurate market data. With a user-friendly point-and-click interface, StrategyQuant caters to traders of all skill levels, requiring no programming expertise to utilize its powerful features and functionalities.

Walnut algorithms

At the forefront of algorithmic trading, Walnut Algorithms uses sophisticated mathematical models and state-of-the-art technology to navigate financial markets. Walnut Algorithms, a quantitative trading strategy specialist, uses complex algorithms to examine market data, spot patterns, and carry out trades effectively. The goal of Walnut Algorithms is to give clients a competitive edge in the fast-paced world of finance by emphasizing innovation and performance. Walnut Algorithms aims to provide traders and investors with improved outcomes and performance by means of thorough research and development, real-world testing, and improvement.

Website: http://www.walnut.ai

Linkedin: https://www.linkedin.com/company/walnut-algorithms/

Industry: IT Services and IT Consulting

Company size: 11-50 employees

Headquarters: Paris, Île-de-France

Founded: 2014

Specialties: Artificial Intelligence, Systematic Trading, and Hedge Fund Management

Orats

ORATS offers a comprehensive tool called the Wheel Backtester, providing a full options package for backtesting, scanning, trading, and risk analysis of options. Traders can thoroughly test their strategies before executing them in the market, enabling them to refine and adjust criteria such as delta and days to expiration, among many other triggers. The Backtester utilizes daily data dating back to 2007, allowing users to simulate option strategies with historical market conditions. ORATS also provides a wealth of resources including back tester samples, instructions, videos, and tutorials to support users in maximizing the potential of their options trading strategies.

Website: http://www.ORATS.com

Linkedin:https://www.linkedin.com/company/option-research-&-technology-services-orats-/

Industry: Capital Markets

Company size:2-10 employees, 3 associated members

Headquarters: Portsmouth, New Hampshire

Founded: 2001

Specialties: Option research., Option trading systems., Implied volatility skews., and Historic option information.

Leave a Reply