Source: thesourcefulceo.com

The future of banking lies in digital platforms. For banks, attracting and retaining customers hinges on delivering a seamless, efficient, and convenient digital experience – one that extends to the initial customer onboarding process.

Recent studies reveal that an overwhelming nine out of ten businesses encounter attrition during onboarding, with the banking sector facing the highest drop-out rate, nearly one in every four new customers.

Customers cite lengthy and convoluted processes as the primary reason for abandoning digital onboarding. This not only results in a potential loss of future revenue but also poses a threat to a company’s reputation in the market.

Digitally welcoming a new customer is not only an essential aspect of the overall customer journey but also a critical means for the institution to gather necessary data and insights. This enables banks to better cater to individual needs through personalized product recommendations and advice while ensuring full compliance with regulatory requirements such as Know Your Customer (KYC).

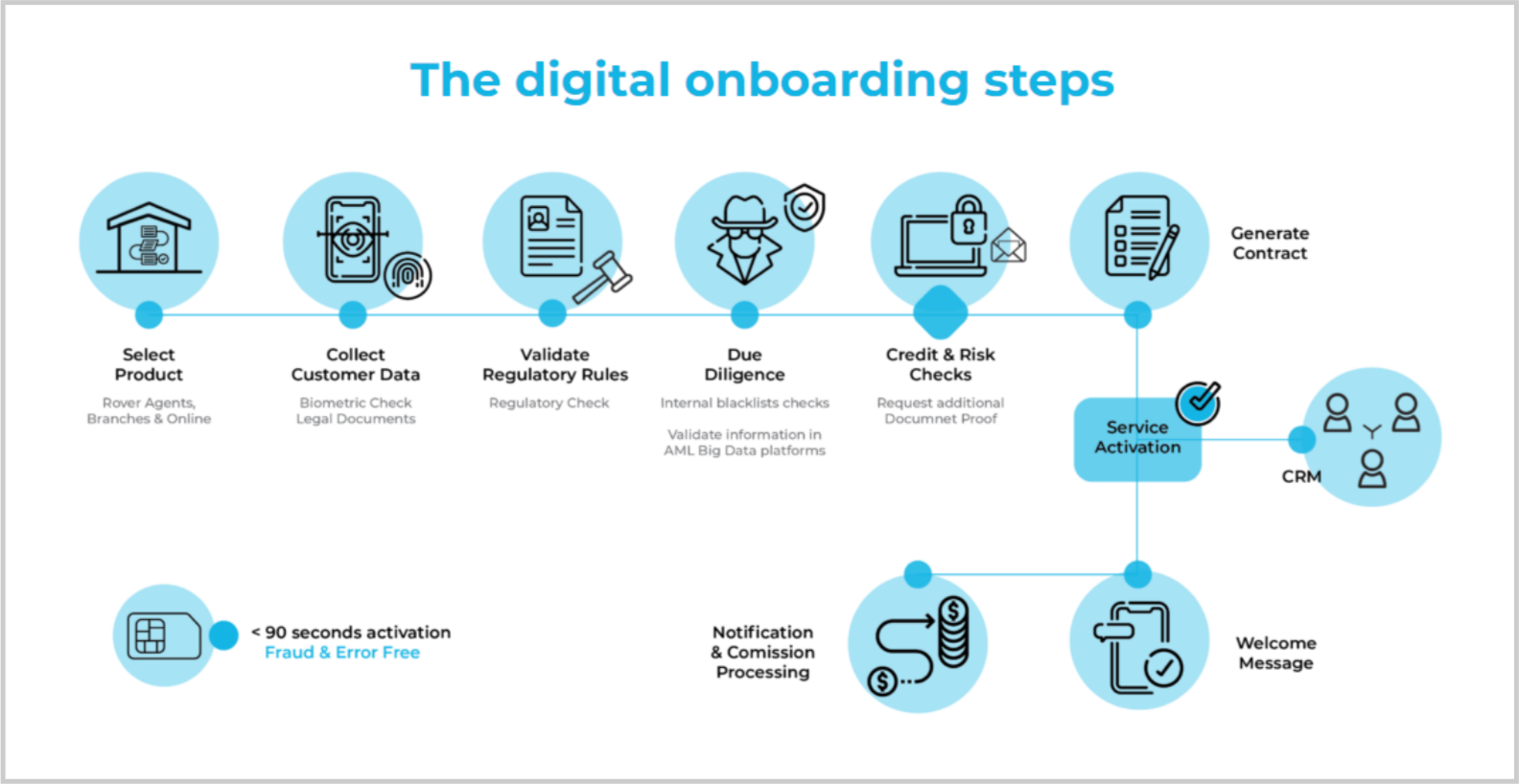

Example of end-to-end Onboarding of a Bank

The Core of Banking’s Customer Onboarding Process

Customer onboarding holds significant importance within the banking sector. It entails integrating new clients into the bank’s system and providing them with the necessary information to make the most of the available services. This process starts with opening an account and extends to educating customers about the various products, services, and banking protocols. A properly organized onboarding process not only boosts customer satisfaction and loyalty but also ensures adherence to essential legal and regulatory requirements.

Five essential components of a comprehensive digital banking onboarding solution

1) Personalized process

source:meridianlink.com

Gone are the days of generic stock letters starting with “Dear New Customer.” Today, when individuals sign up for online services, they expect a personalized experience right from their initial interaction, through the onboarding process, and into their day-to-day banking activities.

Banks now rely on data to tailor their services, which can be collected in various ways. Instead of using generic templates, they may opt to ask specific questions during sign-up to understand customers’ needs better. Additionally, analyzing a customer’s IP address can provide insights into their location and financial situation. Factors like the time of day and the context in which customers engage with the bank’s services can also offer valuable information.

Personalization should extend throughout the entire onboarding journey and beyond. This might involve making subtle adjustments to the interface, such as enabling autocomplete to save customers from repeatedly answering the same questions. Simple gestures, like greeting customers by their first name when they log in, can also enhance the personalized experience.

2)Efficient KYC

Source: kingcasinobonus.uk

While Know Your Customer (KYC) procedures are essential for banks to verify the identities of new customers, the process can often be burdensome during client onboarding. Endless paperwork requirements or struggling with ineffective photo scanning applications can frustrate customers.

For retail banks, KYC processes can drag on for weeks, causing further frustration among new customers. Corporate onboarding is even lengthier, with studies indicating an average process duration of 31 days.

Fortunately, advancements in technology offer solutions to streamline KYC procedures. When scanning passport images or other government-issued documents, it’s crucial to ensure that the system is efficient and robust enough to handle poor-quality images or other imperfections.

Digital identity solutions are increasingly popular for KYC verification. Government-operated electronic identification systems like eID in Estonia or Aadhaar in India, along with services provided by private companies like Experian, can expedite the onboarding process. Magic links, which enable authentication by simply clicking on a link sent via email, are also highly beneficial.

While KYC is mandatory, it doesn’t have to be a stumbling block. Implementing efficient KYC processes can lead to a smoother onboarding experience and ultimately attract more new customers.

3) Completely online process

Source: nationalbank.com

When individuals sign up for services like Spotify or Netflix, they expect a seamless digital experience without the need for physical verification or in-person payments. Similarly, digital consumers are discouraged when they’re required to spend excessive time filling out onboarding forms and submitting identification documents, only to be directed to a physical branch.

For Neobanks and challenger banks, this isn’t typically an issue since they prioritize digital interactions. However, for established financial institutions, this distinction can determine whether they gain or lose a new customer.

Such as electronic signatures (e-sign) To facilitate customer authorization of legal agreements and consent forms, digital onboarding will ideally incorporate electronic signature capabilities, allowing customers to sign documents digitally, eliminating the need for physical paperwork or visits to a branch.

4) Omnichannel experience

Source: dfcloudpbx.com

Providing an omnichannel experience means ensuring that digital onboarding integrates smoothly with a consistent user experience across various devices (such as mobile phones and laptops) and channels (including apps, websites, chatbots, email, and telephone). This entails allowing customers to initiate the onboarding process on one device and seamlessly continue it later on another device without encountering any interruptions or data loss.

In simpler terms, it’s about making sure that customers can start signing up for a service or opening an account on their phone, for example, and then easily switch to their laptop or another device to complete the process without any hassle or loss of information.

5) Smooth chatbot experience

Source: pinterest.com

To enhance the onboarding experience, it’s crucial to offer customers easy access to assistance. This could involve implementing a chatbot initially to address common inquiries or providing access to a call center for more complex issues. Chatbots can be highly effective, answering up to 80% of questions, but it’s essential to have human support available in case customers encounter difficulties beyond automated responses. Achieving the right balance is key, as receiving repetitive responses from a bot can be frustrating and even infuriating for new customers.

During the onboarding process, it’s advisable to steer clear of evoking strong emotions such as anger, as this can prompt customers to impulsively abandon the process if they feel upset or annoyed. Onboarding should be as smooth as possible, with minimal obstacles hindering the journey. Letting customers know that assistance is readily available can make the experience more pleasant and encourage them to complete it.

Customer Onboarding’s Significance in Relationship Building

Customer onboarding plays a crucial role in establishing strong, lasting relationships with customers. It allows banks to address inquiries, foster trust, and showcase their capacity to fulfill both immediate and future customer requirements. A lackluster onboarding encounter can swiftly alienate new customers and potentially subject the bank to legal consequences or penalties. Moreover, customer onboarding serves as a mechanism for assessing the risks linked to engaging with individuals or entities, ensuring smooth operations and security through thorough ID verification procedures.

Simplify Your Digital Onboarding With Customer Identity Verification

Reference;

[1] Wikipedia, Digital-onboarding-Eight-steps-to-create-a-complete-solution. Accessed 5 April 2024.

[2] five-ways-to-assess-your-banks-onboarding-capabilities/. Accessed 5 April 2024.

Leave a Reply