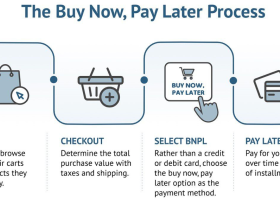

BNPL (Buy Now Pay Later) is a widely popularized sales promotion scheme used across diverse industries to boost sales. Over the years it has achieved immense success in increasing the purchase rate of a wide range of products starting from mobile phones to automobiles. While this has been successful, there are various alternate ways of lending that can serve across both the ends of consumer and shopkeeper.

Image Credits: https://images.app.goo.gl/WgXuMMAy2nkma3Lt9

In today’s blog we are going to discuss in depth the emerging trends in lending, alternative to the Buy Now Pay Later scheme.

Point-of-Sale Financing

Point-of-sale financing extends the convenience of installment plans beyond e-commerce to physical retail environments. Partnering with fintech firms, retailers offer flexible payment options, enhancing the shopping experience. Customers can spread payments over time, often with low or zero interest, increasing affordability. This approach boosts sales for merchants and provides consumers with greater purchasing power, fostering loyalty and satisfaction. Point-of-sale financing reflects the evolving landscape of alternative lending, meeting modern consumers’ preferences for flexibility and convenience.

Peer-to-Peer (P2P) Lending

Peer-to-peer (P2P) lending connects borrowers directly with investors through online platforms, bypassing traditional financial institutions. These platforms utilize technology to match borrowers with suitable lenders and facilitate loan transactions. P2P lending offers borrowers competitive interest rates and flexible terms, while investors can earn attractive returns. However, it also carries risks, including borrower default and lack of regulatory oversight. Despite challenges, P2P lending continues to grow as a popular alternative investment and borrowing option.

Income-Share Agreements (ISA)

Income-Share Agreements (ISA) are financial arrangements where individuals receive funding, typically for education, in exchange for a percentage of their future income. Unlike traditional loans, repayment amounts are based on earnings, offering flexibility for borrowers. ISAs align incentives between students and investors, as payments are contingent on graduates’ income levels. This model has gained popularity for its potential to reduce financial barriers to education and mitigate risk for students.

Digital Banks and Neobanks

Image Credits: https://images.app.goo.gl/RrZEUoxWLpn9gGXD7

Digital banks and neobanks are disrupting traditional banking with tech-driven innovation. Operating solely online, they offer seamless, user-friendly experiences, often with lower fees and higher interest rates. Leveraging AI and data analytics, they provide personalized services and faster, more efficient transactions. With mobile-centric interfaces and 24/7 accessibility, they cater to digital-savvy consumers seeking convenience and flexibility. Digital banks and neobanks represent the future of banking, reshaping financial services for the digital age.

Top 10 Digital Banks of India || India’s Top 10 Neobanking Start-ups

Microfinance and Microlending

Microfinance and microlending empower underserved communities by providing small loans and financial services to individuals who lack access to traditional banking. These initiatives target entrepreneurs, especially women, in developing countries, enabling them to start or expand small businesses, invest in education, and improve their living standards.

Unlike traditional lenders, microfinance institutions focus on building relationships and understanding the unique needs of their clients. They often employ group lending models and peer support networks to promote accountability and repayment. By providing access to capital and financial resources, microfinance and microlending enable individuals to build assets, create opportunities, and break the cycle of poverty.

Cryptocurrency Lending

Image Credits: Unsplash

Cryptocurrency lending enables users to borrow and lend digital assets through decentralized platforms, bypassing traditional financial intermediaries. Smart contracts automate loan terms and collateralization, offering borrowers access to liquidity while providing lenders with attractive returns. This emerging form of lending facilitates efficient capital deployment within the rapidly evolving crypto ecosystem. However, it also carries risks such as volatility and security concerns. Despite these challenges, cryptocurrency lending continues to grow in popularity, driven by the increasing adoption of digital assets and the desire for decentralized financial services.

Crypto Lending Explained For Beginners | How To Earn On Kucoin

Embedded Finance

Embedded finance refers to the integration of financial services seamlessly into non-financial products and services, transforming everyday transactions into opportunities for financial engagement. For instance, e-commerce platforms offer instant loans during checkout, and ride-sharing apps provide drivers with access to vehicle financing. This integration leverages technology to streamline processes, enhance convenience, and improve access to financial products and services for consumers and businesses alike. By embedding financial services into existing platforms and experiences, embedded finance enables greater financial inclusion, empowering individuals and businesses to manage their finances more effectively. This trend is driven by advancements in digital technology, changing consumer expectations, and the desire for more personalized and convenient financial solutions in an increasingly interconnected world.

Regulatory Innovation

Regulatory innovation in alternative lending is revolutionizing the financial landscape, fostering competition, transparency, and inclusion. Initiatives such as open banking and alternative credit scoring models are reshaping traditional lending practices. Open banking mandates banks to share customer data securely with third-party financial service providers, enabling tailored lending solutions and fostering collaboration between incumbents and fintech startups.

Additionally, alternative credit scoring leverages non-traditional data sources, such as utility payments and social media activity, to assess creditworthiness beyond traditional metrics like credit scores. These innovations aim to expand access to credit for underserved populations while enhancing risk management practices. By promoting greater transparency and competition, regulatory innovation in alternative lending is driving financial sector evolution, ultimately benefiting consumers and businesses alike.

Green and Sustainable Finance

Image Credits: Unsplash

Green and sustainable finance focuses on allocating capital to projects and businesses that promote environmental sustainability and social responsibility. This form of finance encompasses investments in renewable energy, clean technologies, energy efficiency, sustainable agriculture, and conservation efforts. It aims to address pressing global challenges such as climate change, biodiversity loss, and resource depletion while generating financial returns.

Green bonds, loans, and funds are key instruments in green and sustainable finance, attracting investors seeking both financial performance and positive environmental impact. Regulatory frameworks, certifications, and reporting standards play crucial roles in ensuring transparency and accountability within the sector. As awareness of environmental and social issues grows, green and sustainable finance is becoming increasingly mainstream, driving innovation and fostering collaboration among financial institutions, corporations, governments, and civil society to build a more resilient and sustainable future.

How The $1 Trillion Green Bond Market Works

Conclusion

These trends indicate a shift towards more diverse and inclusive lending practices, driven by technological innovation, changing consumer behaviors, and evolving regulatory environments. As alternative lending continues to evolve, it will play an increasingly vital role in meeting the diverse financial needs of individuals and businesses worldwide.

Leave a Reply